2021 outlook for the hog market

发布时间:2021-01-16

Outlook for 2021: It is expected that the supply of live pigs will gradually recover, and the price of pigs will be in a downward cycle in 2021. However, considering the constraints on supply due to factors such as the inefficient sow inventory structure and the African swine fever epidemic, the rebound in supply and the decline in pig prices should be relatively slow. It is judged that the average price of live pigs in 2021 will drop by about 30% year-on-year to about 25 yuan/kg, which can still support higher breeding profits.

In terms of inventory data, as of the end of the third quarter of 2020, the national live pig inventory was 370.39 million, an increase of 9.0% over the end of the second quarter.

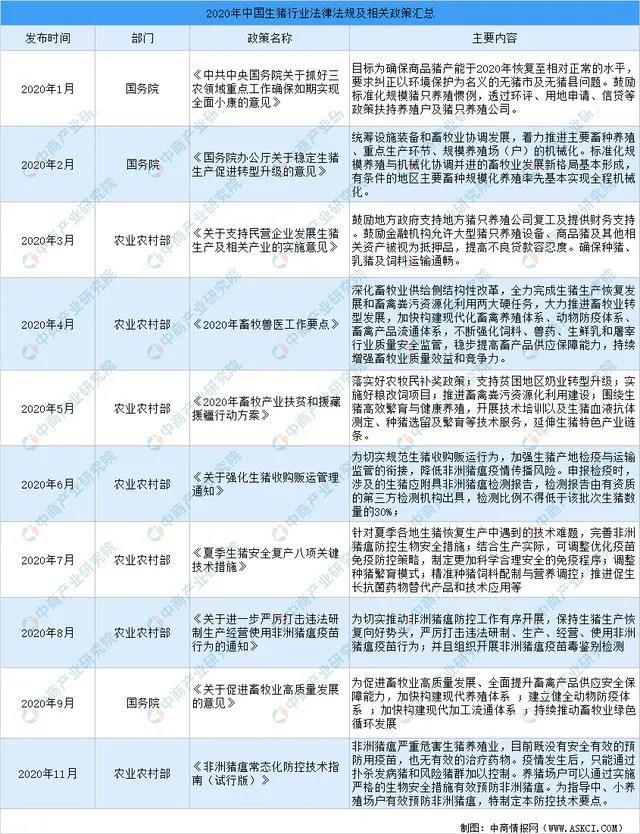

1. National frequent policy – to ensure the stability of live pig prices and the healthy development of the industry

According to rough statistics, there are about 10 policies related to live pigs in 2020, of which 2 are about African swine fever. At the beginning of 2020, the State Council issued the “Opinions on Doing a Good Job in Sannong and Ensuring a Well-off Society in an All-round Way as Scheduled”, and put forward the goal of ensuring that the production capacity of commercial pigs will return to a relatively normal level in 2020.

2. The dual effects of “African Swine Fever” and “New Coronary Pneumonia”

(1) African swine fever

As the country further increases its investment in animal epidemic prevention, various prevention and control measures have been implemented in various places, and African swine fever has been eliminated, and major pig epidemics have been effectively controlled. The epidemic intensity of swine fever and other diseases has been decreasing year by year, the frequency of the incidence has been greatly reduced, and the scope of the disease has been significantly reduced. New outbreaks have dropped significantly, and Hainan, Liaoning, and Jilin Yongji have established immune-free areas for foot-and-mouth disease. Major pig epidemics such as foot-and-mouth disease were generally stable, and no major regional pig epidemics occurred.

African swine fever has also had an impact on the hog industry:

In the absence of an effective vaccine, the ASF virus cannot be completely eradicated, and the probability of occurrence can only be reduced by improving the industrial environment and enhancing the level of prevention and control. Compared with the initial stage, the current key epidemic prevention work has been strengthened in terms of illegal transfer of live pigs Since March this year, 13 cases of African swine fever in domestic pigs have been reported nationwide, most of which were caused by illegal transportation. The advantages of one-stop breeding and slaughtering enterprises are more obvious, and the risk of cold chain transportation of white meat can be greatly reduced.

African swine fever also affects the pig industry

01The impact on pork prices

It is inevitable that the price of live pigs in the epidemic area cannot go out of the province, while the price of pigs in the sales area may rise steadily due to the shortage of supply.

02 “South pigs are raised in the north” to cool down

There are two places that farming and animal husbandry giants are most enthusiastic about: the northeast and southwest, and the African swine fever was first discovered in the northeast, which will also make the investment of farming and animal husbandry enterprises face a round of policies and the test of the epidemic.

The new crown pneumonia epidemic has had a certain impact on pig production, but it has not fundamentally changed the positive trend of pig production recovery. The epidemic mainly affected some feed, veterinary drugs, and slaughtering enterprises that failed to resume production as planned. Some farms were prevented from animal epidemic prevention, breeding pigs, and piglets replenishment, and the resumption of new and expanded pig farms was forced to be postponed.

From the perspective of consumer prices, in November 2020, my country’s live pig production capacity continued to recover, pork supply continued to improve, and prices fell -12.5%, an increase of about 10 percentage points from the previous month.

Judging from the wholesale price of pork, the national average wholesale price of pork in November was 39.43 yuan/kg, down about 3 yuan/kg from the previous month, and fell below 40 yuan for the first time this year.

1. Market size

The market size of commercial pigs calculated by sales revenue fluctuates with the pig cycle, and the market size gradually declines due to the pig cycle and the withdrawal of local farmers from the market. The market is expected to recover slowly.

The breeding pig market reached a historical peak in 2016 with high pig prices and has since started to decline. After the end of 2019, the pig market as a whole recovered slowly. In 2020, due to the impact of the new crown epidemic and African swine fever, the demand for pork across the country has risen, and the market size is expected to reach 86.5 billion yuan in 2021. In this case, large breeding pig companies will have the opportunity to gain a larger market share.

2. Sow inventory

Due to the outbreak of African swine fever, China’s sow herds dropped sharply in 2018 and 2019, and this number is expected to recover from the recovery of breeding pig supply, favorable policies and the capacity expansion of large pig breeding companies, which is expected to start in 2021. will get better.

China’s commercial pig stock will also be negatively affected by African swine fever and environmental protection restrictions. The commercial pig stock has dropped sharply recently. China’s commercial pig stock is expected to rebound after 2020, and is expected to reach about 250.8 million in 2021.

In December 2020, Zhengbang Technology disclosed in the investor survey record that it is expected that the company will sell 25 million pigs in 2021; New Hope also stated that the target of 25 million pigs will remain unchanged in 2021; At the end of the month, the total number of live pigs was about 22 million, and it is expected that the number of breeding sows will reach about 2.6 million by the end of the year. In addition, Muyuan shares also stated that the company has currently reserved more than 80 million pigs. The corresponding land for the production capacity of pigs. It is estimated that by the end of 2020, the production capacity will reach about 50 million heads. For the 2021 live pig slaughter plan, it depends on the construction and pig farm delivery in 2020. It is expected to be disclosed in the 2020 annual report that the company’s production capacity expansion has shown a momentum of increasing quarter by quarter, and the high slaughter volume in 2021-2022 can be expected.

It is worth noting that twins, as the representative of pig raising by feeding companies, should not be underestimated in their pig production capacity. In 2019, the number of live twins sold for slaughter exceeded 2 million, and the target for slaughter in 2020 is 5 million. Although the twins have not announced plans for slaughtering pigs in 2021, they have previously announced that they will challenge the goal of slaughtering 40 million pigs in 2023.

From the perspective of various enterprises, Muyuan, Wen’s and Zhengbang’s live pig slaughtering plans in 2021 will rank in the top three, with 5,000, 3,000 and 25 million heads respectively. Aonong Bio’s 2021 live pig slaughter plan has the highest growth rate of 220%, which is 3.2 times the 2021 slaughter plan. In addition, Muyuan, Tianbang, Wen’s, Dabeinong, etc. have also increased by more than 150%, and 8 of the 10 companies have plans to sell more than 100%.

In 2021, from the supply side, the supply of pork will continue to increase. On the one hand, the slaughter volume and slaughter volume of live pigs are expected to increase; on the other hand, the supply of frozen meat is relatively limited. From the demand side, pork consumption has increased. Mainly because the New Year’s Day and the Spring Festival are approaching, especially the Sichuan-Chongqing and Lianghu regions have begun to make cured pork, and the demand for pork purchases has increased significantly. Based on the above analysis, it is expected that there will be no significant increase in pork prices in 2021.

QQ咨询

QQ咨询 拨打电话

拨打电话 在线留言

在线留言