Review: Top 10 most watched events in the pig industry in 2020! (superior)

发布时间:2020-12-24

In 2020, the pig industry will continue to have major events. The sun is new every day, and our eyes are always lit. We have witnessed the great changes in history, and we have also experienced the subversion of the industry.

The industry leader has been relocated, the pig giant has made a rush, the sky-high market price has been ups and downs, the ASF vaccine has been rejected, the official announcement that the production capacity of live pigs has been restored to 90%… In 2020, every major event has caused the industry Uproar.

1. Muyuan has become the number one pig production in my country

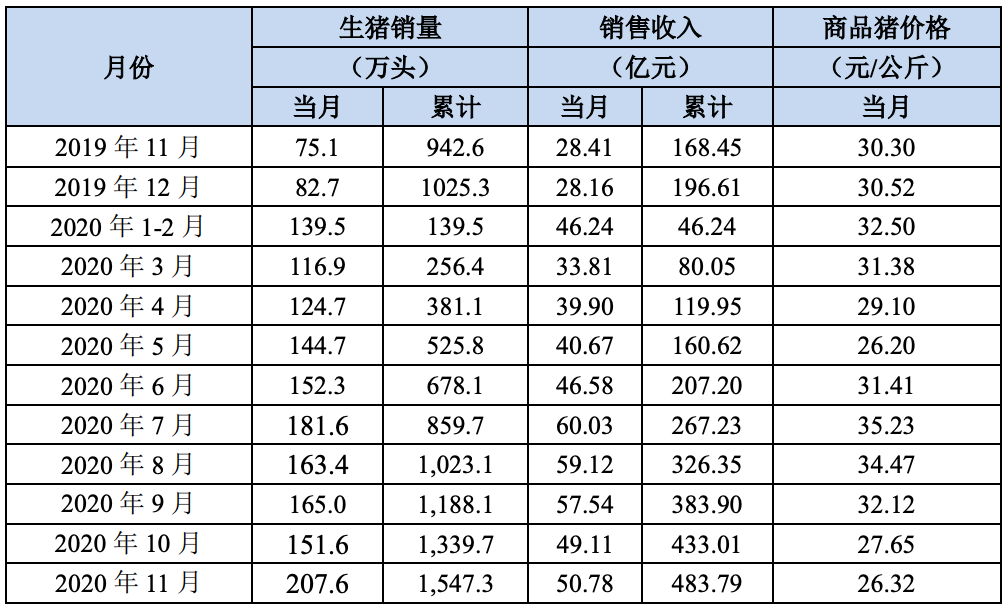

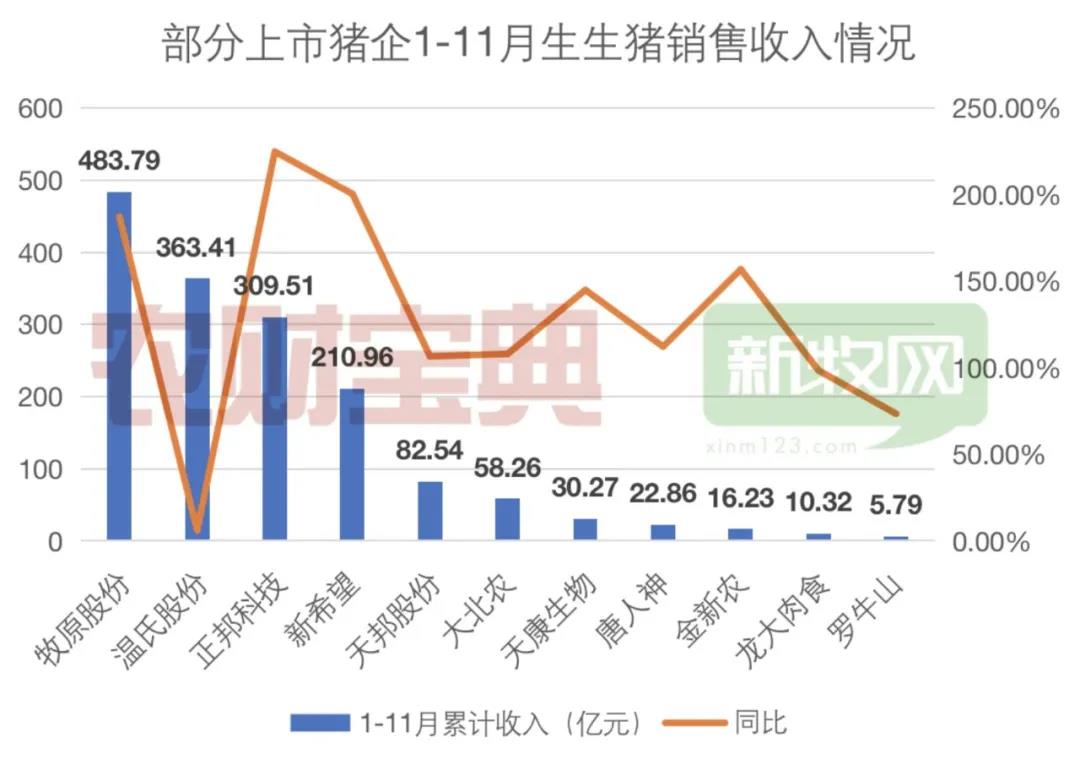

In March 2020, Muyuan Co., Ltd. won the first place in the live pig slaughtering list for the first time, and then the momentum continued to rise steadily. In November, the number of live pigs sold by Muyuan Co., Ltd. exceeded 2 million in a single month. At present, the number of live pigs sold by Muyuan Co., Ltd. in the first 11 months has reached 15.473 million heads. enterprise. Judging from the current situation, there is a high probability that Muyuan Co., Ltd. can achieve the goal of slaughtering 17.5-20 million live pigs in 2020.

From January to November 2020, Muyuan Co., Ltd. sold 15.473 million live pigs, with a cumulative sales income of 48.379 billion yuan

Under the huge gap, whoever can take the lead in the layout and seize more market share will be able to seize the fate of the next stage of competition. Obviously, Muyuan Co., Ltd. is at the forefront of the historical trend. Facts have proved that Muyuan’s self-propagating and self-raising pig-raising model with high assets has withstood the test of ASF, and it has benefited more significantly from the accelerated expansion of production capacity in this round of pig cycles.

2. African swine fever vaccine failed to market

When will the African swine fever vaccine be available? Before the Internet rumors were rampant, the end of 2019, May 1, 2020, National Day in 2020 and other time nodes were all rumored to be magical. However, up to now, the vaccine has not been successfully launched, and it is even reported that the vaccine was unanimously rejected in the expert review process.

The ASF vaccine has been controversial in trials and wait-and-sees. Research on ASF vaccine is the right of scientists. When it can be marketed, it does need to be carefully considered. Many people in the industry say that the current vaccine is not suitable. The African swine fever vaccine is a worldwide problem. If it is put on the market for the sake of listing, it will bring more harm to the pig industry than the epidemic itself, and all the efforts made for the prevention and control of African swine fever in the past two years will be destroyed. At relevant professional conferences, some experts disclosed that wild vaccines already exist in some areas, and the harm is not shallow. After two years of fighting against Africa, Chinese farmers have summed up a lot of prevention and control experience. For some farmers, vaccines are no longer a necessity. We look forward to an effective and safe vaccine, but we can’t completely stress on a vaccine that is still under research and controversy.

3. The six central and southern provinces prohibit the transfer of live pigs

From November 30, 2020, the six central and southern provinces will completely prohibit the transfer of live pigs (except breeding pigs and piglets) from non-central and southern regions. dispatch. When the supply of live pigs and live pig products in the area is insufficient or there is an emergency, under certain conditions, the “point-to-point” dispatch of live pigs can be started, and the straight-line distance in principle does not exceed 1,000 kilometers.

The ban on the transfer of live pigs in the central and southern regions is a favorable exploration for the prevention and control of ASF, but for small and medium-sized pig enterprises in the live pig production areas, selling pigs under the ban has become the biggest difficulty. At the same time, the pattern of “raising pigs from the south to the north” may also be completely broken. In the future, the live pig market will become a sales area market, and the layout of pig enterprises will be more inclined to pork consumption provinces. Each province is responsible for its own supply of live pigs, which is one of the important reasons why local governments have vigorously supported and attracted pig enterprises to raise pigs in the past two years.

4. Officially announced that the production capacity has been restored to 90%, and 2.28 million new farmers have been added.

The Ministry of Agriculture and Rural Affairs stated on December 15, 2020 that according to the monitoring of the full coverage of large-scale pig farms across the country, in November, the number of large-scale pig farms with an annual output of more than 500 heads increased from 161,000 at the beginning of the year to 177,000. There are also more than 15,000 pig farms that have resumed breeding. From the perspective of free-range farmers, the enthusiasm for supplementing the pens is also increasing, and the number of pig farmers has increased by 2.28 million compared with the beginning of the year. As of the end of November, the national live pig inventory and reproductive sow inventory have recovered to more than 90% of the normal level, 23 provinces have completed the production capacity recovery task ahead of schedule, and the national live pig inventory will return to the normal level by the first half of next year at the latest. level.

5. New Hope, Zhengbang, Twins and other agricultural and animal husbandry enterprises overtake in pig-raising curves

Harvest pig cycle dividends, expand feed business, and deploy the entire industry chain. In 2020, New Hope Liuhe, Zhengbang, Twins and other feeding companies have emerged in the fierce competition, and quickly entered the first camp of pig breeding giants. As of the end of November 2020, Zhengbang had produced a total of 8.2176 million live pigs throughout the year, ranking third. New Hope also sold 6.6343 million live pigs in the first 11 months. In addition, as of November, New Hope had 2.05 million breeding pigs, including about 1.16 million breeding sows and about 890,000 gilts. In 2017, the twins made a big push into the pig industry. By 2019, the twins’ annual slaughter volume of live pigs has reached 2 million in three years, and in 2020, it is planned that the number of live pigs will reach 5 million… In just a few years, The scale of live pig breeding of some feeding companies exceeds that of some listed pig companies.

At the same time, African swine fever has also created unprecedented bargain-hunting opportunities for feed companies. The layout of pig raising by feed enterprises can not only harvest pig price dividends, but also its new model of “self-production and self-sale” plays an important role in the healthy development of the feed sector. At the same time, feeding companies have natural advantages in entering the pig industry, such as strong financial strength, lower feed costs, good agricultural and animal husbandry genes and resources, and latecomer advantages, etc., which allow feeding companies to deploy pig breeding during the policy dividend period. Rapid development stand up.

QQ咨询

QQ咨询 拨打电话

拨打电话 在线留言

在线留言