Review: Top 10 most watched events in the pig industry in 2020! (Down)

发布时间:2020-12-24

6. The price of pigs broke through the 19 yuan mark twice and remained high and volatile

In 2020, the national price of live pigs has “twisted and twisted”, out of an “M”-shaped trend, breaking the 19 yuan/catties mark twice, the annual high reaching 19.77 yuan/catties, and the lowest price being 13.62 yuan The price of pigs fluctuated more than 6 yuan per kilogram during the year, but the price of pigs remained at a high level throughout the year. The Founder Medium-term Futures Research Institute predicts that the average price of live pigs in the whole year of 2020 may not be lower than 29 yuan/kg.

The price of pigs in 2020 is unprecedented. It has never been seen before, and it is estimated that there will not be any in the future. Although pig prices in 2020 did not break through last year’s highest point, they remained in a high range throughout the year. Will the price of pigs go up again? Farmers don’t care so much anymore, they are more worried about when the price of pigs will fall, and how sharply it will fall. For example, Tao Yishan, chairman of Tang Renshen, said that “the price of pigs will drop to 10 yuan/catties in 2022, or even 4-5 yuan/catties”, which caused an uproar in the industry and made many farmers start to be vigilant. In general, with the gradual recovery of live pig production capacity, the decline in pig prices is an inevitable trend, and pig raising will also change from racing to cost competition.

7. Imported pork may exceed 4 million tons, 2.5 times the history

According to the latest customs data, my country imported 330,000 tons of pork in October 2020, and the accumulated pork imports from January to October were 3.62 million tons, a year-on-year increase of 126.2%. From the perspective of the whole year, November to December is the peak season for pork consumption, and the import volume of pork in 2020 will easily exceed 4 million tons. It is worth noting that before the occurrence of African swine fever, the historical high of pork imports was 1.62 million tons in 2016. The annual pork import volume this year may be more than 2.5 times that of 2016 and 2.994 million tons in 2019. times more.

Imported pork has never been liked or even rejected by pig farmers. As an important supplementary source of domestic pork supply, this year’s pork imports hit a record high, which to a certain extent also reflects the huge domestic pork supply gap. In addition, under the new crown epidemic, the imported cold chain has frequently tested positive, which also makes the safety of imported meat questionable. With the recovery of domestic pig production capacity and the impact of food safety issues in the global cold chain on pork import trade under the new crown epidemic, the demand for pork imports will gradually decrease in the future.

8. The 26-story high-rise building shocked the industry, and the pig raising project in the building was launched intensively

According to reports, as of the end of July 2020, as many as 64 building pig raising projects have been launched intensively in Sichuan Province. Pig raising in buildings has not only sprung up like bamboo shoots after a rain, but has also grown higher and higher. On August 17, 2020, the foundation stone was laid for the 26-story high-rise pig raising project of Hubei Zhongxin Kaiwei Modern Animal Husbandry Co., Ltd., which shocked the entire pig industry. In addition, according to the statistics of Xinmu.com of Agricultural Treasure Collection, since 2020, Wenshi, Muyuan, New Hope, Luoniushan, Tianzhao Pig Industry, Lihua Co., Ltd. and other pig-raising enterprises have deployed more than 40 pig-raising projects in buildings.

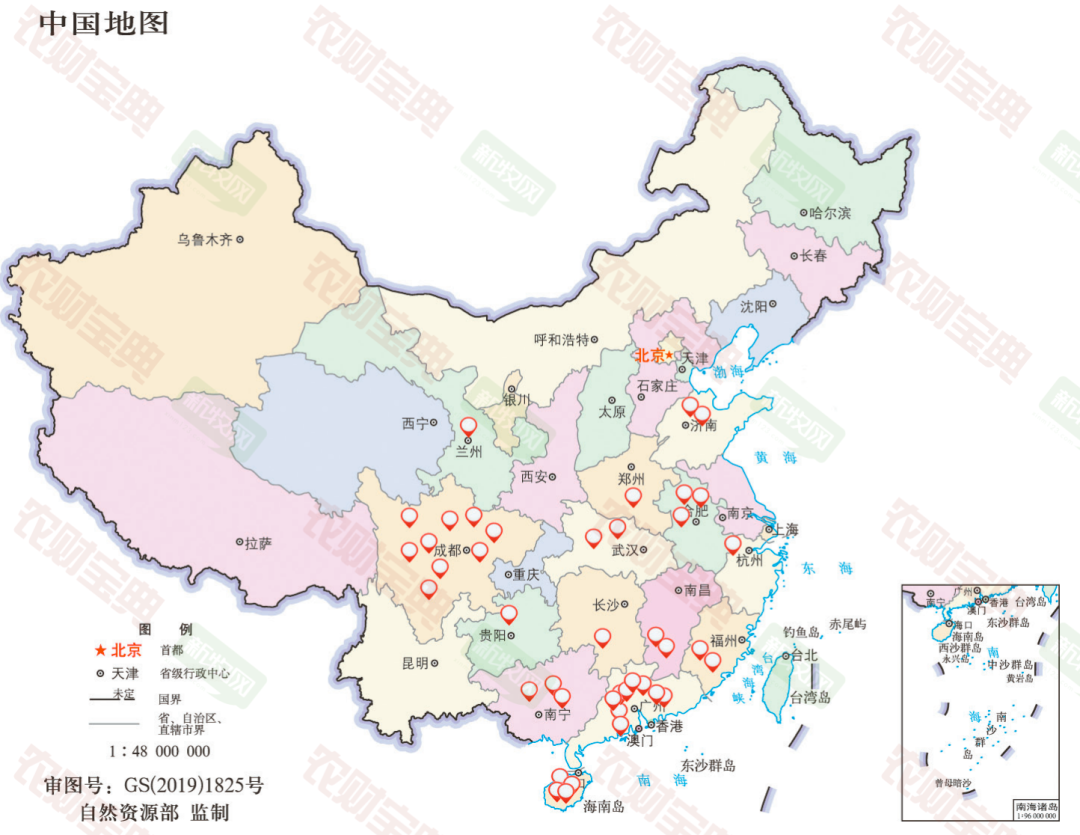

Distribution of pig raising projects in buildings that have been completed and put into production (including projects under construction) across the country

Why is pig raising in buildings suddenly so popular? In the era of the loosest pig breeding policy, in order to seize opportunities and occupy a larger market share, pig enterprises will naturally not let go of the field of building pig breeding under the limited breeding land resources – on the same size of land , The pigs raised are several times that of ordinary pig farms.

Traditional tiled pig farms belong to facility agricultural land, and the approval procedures for building pigs are relatively complicated. In the past, it was really difficult to build buildings to raise pigs. In order to solve the problem of breeding land, in December 2019, the Ministry of Natural Resources and the Ministry of Agriculture and Rural Affairs jointly issued the “Notice on Issues Concerning the Management of Facility Agricultural Land”, and announced for the first time that breeding facilities are allowed to build multi-storey buildings, opening a policy opening. Although building pigs has the advantages of alleviating land use conflicts, improving management efficiency, and high intelligence, the problems of large initial investment in building pigs, high construction costs, and difficult control of major infectious diseases cannot be ignored.

9. Breeding pigs are scarce and over 20,000 are introduced abroad

According to the report on the breeding pig market of the Agricultural Finance Think Tank, as of March 2020, according to the survey data, it is estimated that the national core group of breeding pigs has dropped by about 30% compared with before the occurrence of African swine fever. In the tight supply of purebred and hybrid sows, the prices of binary sows and piglets have also hit new highs. The price of a 40kg sow in a core breeding farm in Henan Province is as high as 8,000 yuan per head. In the second half of 2019, the proportion of ternary sows reserved for breeding began to gradually increase. By the first half of 2020, data from the COFCO Futures Research Center showed that ternary sows accounted for as much as 45% of domestic sows, and it is expected that sows will be scarce within 2 years. The industry attributes will not be changed. At the same time, the introduction of foreign breeding pigs in 2020 also ushered in a “blowout period”. According to incomplete statistics, as of the end of November, the number of purebred pigs imported into my country in 2020 has reached 22,191, and the number has exceeded 20,000, a record high.

2020年部分企业种猪引种情况(不完全统计)

10. Hog futures are finally here

Start calling out! For years, the industry has been clamoring for an effective tool against the risk of swine price volatility as soon as possible, and it’s finally here. On December 11, 2020, the China Securities Regulatory Commission announced that hog futures will be listed on the Dalian Commodity Exchange from January 8, 2021. This is my country’s first futures product with living body as the trading target.

Pig futures, which have been brewing for nearly 20 years, have finally landed, which is a good thing for pig farmers. For a long time, the pig industry has been plagued by the pig cycle. In the absence of effective long-term price guidance and hedging tools, pig breeding enterprises often blindly expand or reduce production, and the result is deeper and deeper. The use of the futures market can help aquaculture enterprises to predict the future price trend in a timely manner and lock in the income of aquaculture. In theory, the smooth implementation of live pig futures can reduce the cyclical fluctuations in pig prices and make the production arrangements of the entire industry more rational and stable.

QQ咨询

QQ咨询 拨打电话

拨打电话 在线留言

在线留言